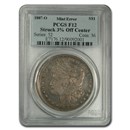

Silver Error Coins

| Grade | Mintage | Population |

|---|---|---|

| 11,550,000 | 23 |

Silver Error Coins

Silver error coins are a fascinating category of numismatic collectibles that combine the allure of precious metal with the intrigue of minting errors. These coins are made of silver and possess errors or irregularities in their production, making them unique and highly sought after by collectors.

Minting errors can occur during various stages of the coin production process. Some common types of errors found on silver coins include planchet errors, die errors, and striking errors:

- Planchet Errors: These errors occur during the preparation of the coin blanks or planchets. They can involve incorrect alloy mixtures, incomplete or misshapen blanks, or foreign materials embedded in the coin. For example, a silver coin may have a planchet that is too thick or thin, resulting in an irregular shape or weight.

- Die Errors: Die errors occur when the coin dies, which are engraved with the design, are damaged or altered in some way. This can lead to anomalies on the coins, such as doubling, missing design elements, or distorted features. Die cracks, cuds (raised lumps on the coin's surface), and rotated dies are some examples of die errors.

- Striking Errors: These errors happen during the striking process when the coin is stamped with the dies. If there is an issue with the alignment or pressure, it can result in double strikes, off-center strikes, or incomplete strikes. These errors can cause overlapping or misaligned design elements on the coin's surface.

Silver error coins can be found in various denominations and designs, depending on the country of origin. The value of these coins can vary greatly, depending on factors such as the severity and rarity of the error, the coin's condition, and the demand from collectors.

Collecting silver error coins can be an exciting pursuit for numismatic enthusiasts. It requires a keen eye for identifying errors and an understanding of their rarity and desirability among collectors. Many collectors enjoy the challenge of finding these unique coins in circulation, attending coin shows, or purchasing them from reputable dealers or online platforms.

It's important to note that the value of silver error coins is not solely determined by their silver content or current spot price of silver but also by their numismatic value. Some errors may be more valuable than others, and it's advisable to consult price guides, reference books, or professional coin grading services to determine their worth accurately.

Remember to handle and store silver error coins carefully to preserve their condition, as any damage or cleaning attempts can significantly affect their value.

Benefits to Purchasing Silver

Silver is a precious metal that has been recognized as a store of value for centuries. It holds intrinsic value and has been used as currency throughout history. Its rarity, industrial uses, and appeal in jewelry make it a sought-after commodity.

Silver also provides diversification within an investment portfolio. It has a low correlation to other asset classes like stocks and bonds, which means it can help reduce overall portfolio volatility. Adding silver to a diversified investment strategy can potentially enhance risk-adjusted returns.

Silver is often considered an effective hedge against inflation. When the purchasing power of fiat currencies declines due to inflationary pressures, the value of silver tends to rise. As a tangible asset, silver can help preserve wealth during times of inflation.

Compared to other precious metals like gold, silver is relatively more affordable. This accessibility makes it easier for a wider range of investors to participate in the precious metals market. It allows individuals to start investing in physical silver in smaller denominations or opt for silver-backed investment products.

Unlike certain investment instruments that exist only in digital or paper form, silver is a tangible asset that you can physically hold. Owning physical silver coins, bars, or rounds can provide a sense of security and tangible wealth. It also offers the potential for numismatic collecting, where the value of certain silver coins can appreciate due to rarity and historical significance.